Mobile Phones are the future

Over the past decade, cellular devices have changed the way we live. On the go information and accessibility, allows for faster and seamless communication. Mobile phones are not just used for communication anymore, they provide a whole range of services. Shopping, news on the go, social networking, photography, business, all in the palm of our hands. Mobiles have revolutionized the way we live our lives.

Leveraging cellular devices

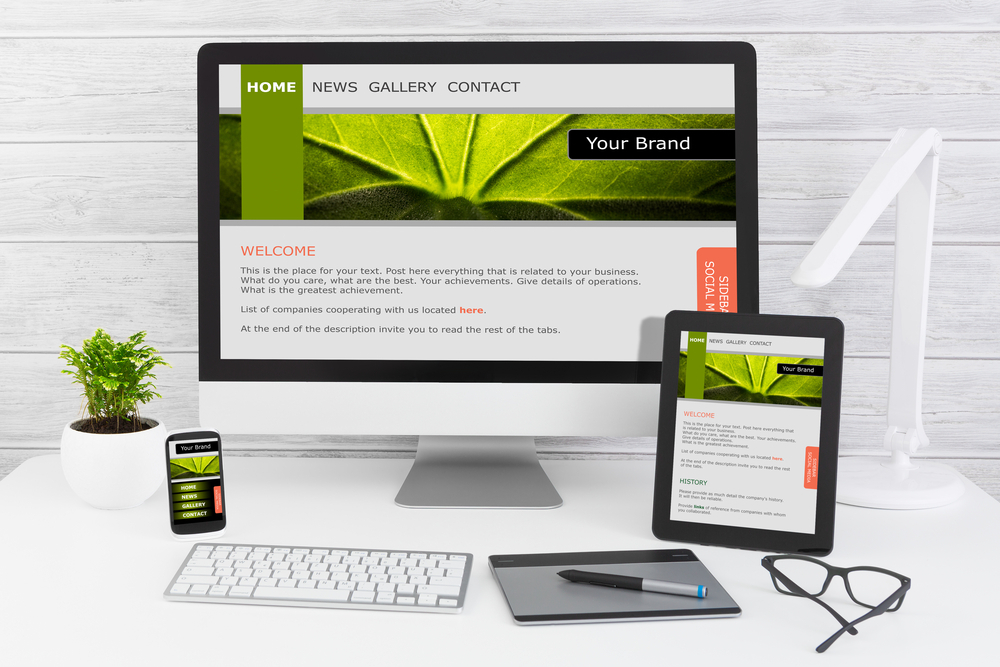

With mobile phones becoming cheaper and smarter, the only logical step for companies was to develop apps for their businesses. Enabling customers to avail the services directly or buy products from the source.

Companies can provide services to people, while simultaneously keeping a track of individual clients via an app. This is especially useful for investment companies that need to keep track of thousands of traders joining and new deals happening daily.

Digitize your investment business

The pandemic helped companies that had mobile apps supersede those that didn’t. When the world went digital, companies that didn’t invest in some form of digitization suffered. When it comes to investment services, the need to stay up to date is of the utmost importance.

The need to meet clients in person to negotiate business terms and consult them was no longer a possibility. People had to maintain their distance and conduct business. This is where digitized investment services gained the upper hand. It allowed traders to sit in the comfort of their home and continue trading.

However, while the pandemic may have helped speed the digitization of investment business, few companies have already been following this model for a while. It gave birth to an entire generation of people who preferred DIY investing, rather than roping in an agent or agency to start trading.

Most of these apps charge no commission and have no minimum account requirements, unlike traditional investment service companies. However, investing via an app does have a few drawbacks

- Without an agency or agency, investors must be well versed in all facets of investing, they must create and maintain their own portfolio.

- Owing to this DIY style of investing, advisors are not available.

- No company or individual will be responsible for personal loss.

- Most investment apps don’t provide retirement accounts

While there are a few drawbacks, the pros outweigh the cons by a huge margin. Let’s take a look at why investment companies should invest in an app.

Real-time market data

Unlike traditional forms of trading, an app will simply do things for the customer and the company. Users gain access to real-time market data and allow for faster trading. enabling companies to make more commission off of transactions.

While it may be impossible for an agency to provide information in a holistic manner; apps can provide data for financial markets as well as provide data like the last sale, best bid and ask price for assets across the country, all in real-time.

An app that can provide these services, will obviously attract a larger trader base which helps the company’s reputation grow

High-level security.

Investment apps ensure that all sensitive user data is encrypted. The scope of the human era is limited as everything is digitized. Traders are always on the lookout for faster and safer methods of trading, the app provides both.

Push notifications

Unlike agents or traditional investment companies, investment companies that have invested in an app, offer their users regular business updates. Traders will receive regular notifications about stock positions and upcoming events like IPO.

Foreign Stocks

Investment apps, unlike traditional investment companies, provide their user base the ability to access almost all listed stocks. Some apps even allow users to invest in foreign stocks. This can be a huge advantage to the company as it provides investment opportunities outside the country, further increasing its portfolio.

Instant access to funds

Investment apps allow traders to access their bank accounts immediately via the app. This not only saves the user time but allows for a faster trading experience. In the world of investment, seconds matter a lot. Traditional investment companies or agents cannot offer the services as fast as an app can. Trading via an app removes the usual waiting time as well, which increases the value of the company that has gone digital.

Easy to use

As mentioned before, investment apps are easy to use. Even a novice can learn to use it proficiently. Nowadays people prefer managing their own portfolio rather than paying an agent or company to do it for them. Companies that have investment apps benefit as traders can open an account and oversee it themselves.

Void of physical presence

Investment companies that go digital make higher profits due to needing less staff. The app can manage thousands of accounts and oversee corruption-free trading, which removes the need for agents. It cuts the costs of having multiple physical locations, as everything is done digitally.